Build a better onchain dollar

Generic provides stablecoin-as-a-service that delivers you the best risk-adjusted onchain yield and payments-ready privacy without the overhead and cost of offchain issuers.

Shared liquidity

Each instance is customisable on top of a shared liquidity and accounting layer, compounding integrations

Neutral economics

You get the best risk-adjusted onchain yield to fund adoption without the cost of issuer dependencies

Embedded privacy

Protocol-level integrated privacy and confidentiality at a speed suitable for everyday payments

Security first

Fully onchain, Tier 1 audits and the best risk curation delivering uncompromising security and transparency

Partners

We are building Generic with best-in-class partners across yield sourcing, risk curation, cross-chain messaging, value routing and more.

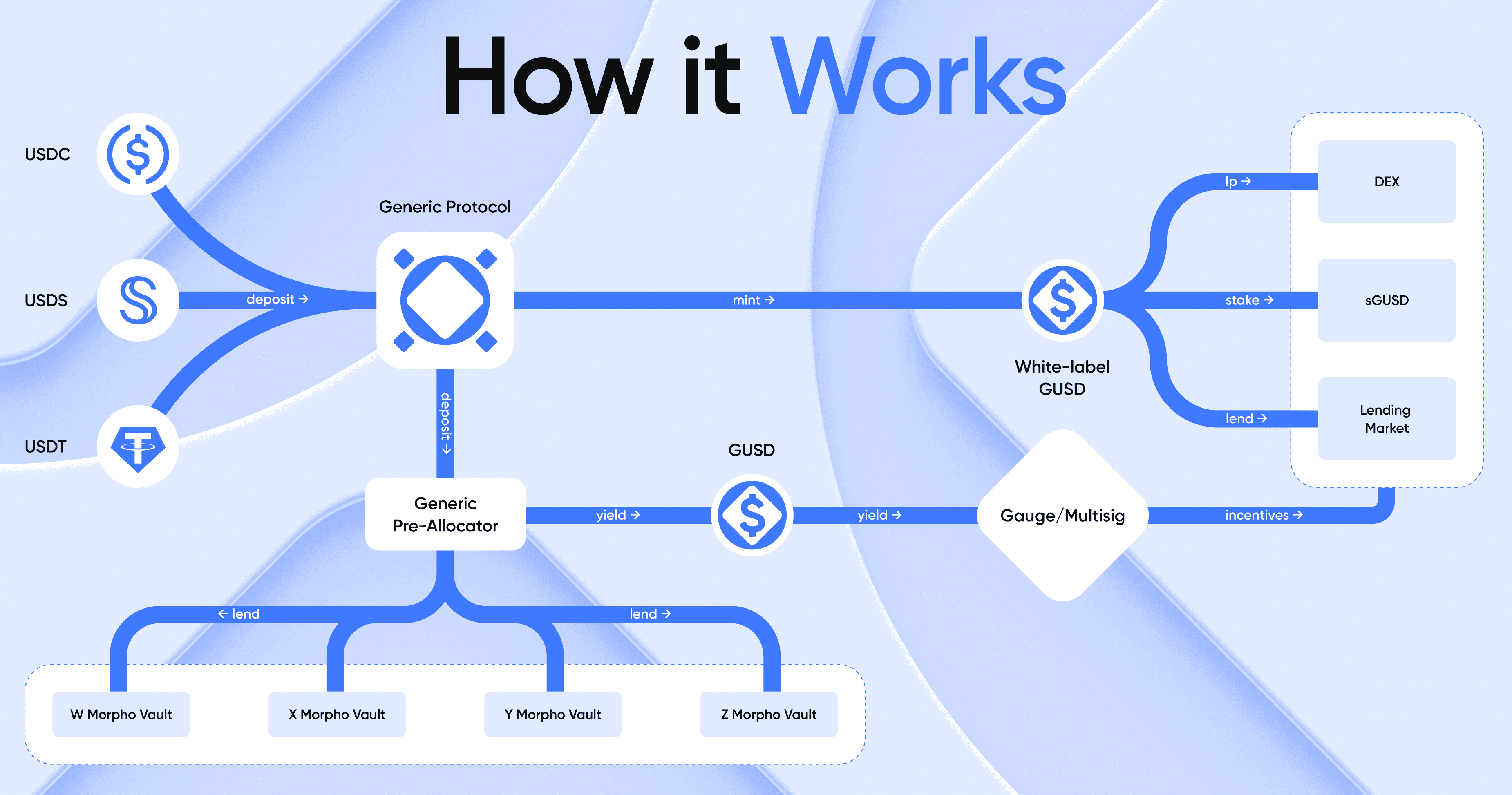

How it works - liquidity and yield

Generic builds on top of the most widely adopted stablecoins (USDC/USDT/USDS) to provide apps and networks with their own native dollar. Liquidity and integrations are shared across the system to ensure network effects compound, while each instance is configurable.

Minting

- Mint GUSD to the target network/app through Generic (abstracted).

- 1:1 backed by stablecoin collateral held in the Generic Protocol.

- Networks/apps run their own configurable wrapper on GUSD while benefitting from the shared rails (liquidity and integrations).

Usage

- GUSD is usable as the default onchain dollar across the stack.

- Provide DEX liquidity, lend/borrow in money markets, stake as sGUSD, make private payments.

Yield

- Collateral is allocated into curated onchain strategies on Ethereum.

- Yield accrues back and is passed to the distribution layer.

- Yield funds liquidity, incentives, and ecosystem programs, creating a compounding adoption loop.

How it works - practical privacy

Generic makes GUSD usable as money: private by default, provable on demand. It combines an FHE-powered Privacy Pool with compliance-grade proofs, so payments use cases don’t collapse into compliance friction and latency.

Private mint

- Users mint directly into the Privacy Pool in one step.

- A single KYT check is executed, providing the transfer with a “clean” attestation without exposing the user.

- Users transact without re-running checks on every hop, removing payment latency.

Confidential payments through FHE balances

- Balances and amounts remain confidential at the protocol level via FHE.

- Transfers stay compatible with standard onchain routing and settlement.

- Payment UX gets fast without “compliance latency” baked into every transfer.

Selective disclosure

- Users can generate exclusion proofs to show they’re not associated with flagged activity.

- Selective disclosure supports regulated endpoints without global deanonymisation.

- Privacy where it matters, credibility where it’s required.

Fueling your growth

Generic helps you build a stablecoin that serves as a growth engine by delivering shared liquidity, configurable instances, yield you direct to fund adoption, and privacy that works in practice.

Compounding liquidity and integrations

- Liquidity remains unified through shared rails.

- With a single pattern, integrations are composable across stablecoin instances.

Yield that funds adoption

- You receive the best onchain yield to fund liquidity, incentives, or share with users.

- Adoption turns the yield into an ongoing revenue stream for you, not an issuer.

Payments-ready confidentiality

- FHE-powered Privacy Pool for confidential balances and transfers.

- "Prove when needed" for regulated endpoints, without slowing every transfer.

Your instance, without issuer overhead

- Each network or app configures its instance: limits, disclosure modes, yield routing.

- No offchain issuer stack to depend on or pay rent to.